Some Known Incorrect Statements About Sole Trader Accountants

5 Advantages And Disadvantages Of Being A Sole Trader

Getting The How to start a business or become self-employed To Work

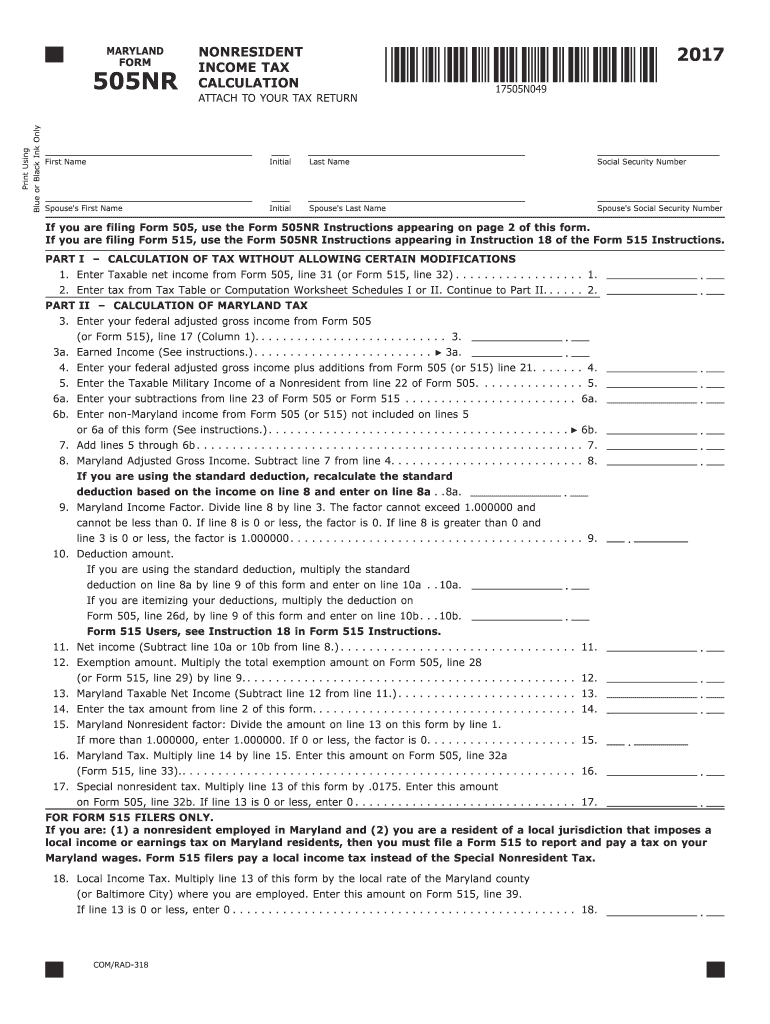

Type of Task, Estimated Cost One-off basic accounting25 to 50 per hour Basic accounting for little business60 to 250 per month One-off expert accounting 125 to 150 per hour Self-assessment and tax returns150 to 250 (one-off cost) For a basic project involving a one-off frequency of standard accounting, you can expect costs of in between 25 to 50 per hour, while a one-off of expert accounting can fall in between 125 and 150 per hour.

Should I be a Sole Trade or Limited Company when starting my video games business? - Plus Accounting

Self-Employed Accounting & Tax Software - QuickBooks UK

Lastly, for a self-assessment or tax return completion, you can expect one-off expenses of in between 150 to 250. Next, let's have a look at some more one-off service expenses for accounting professionals, based on business turnover or employee count. More than accountants , Turnover or Workers, Estimated Cost Company accounting (one-off)20,000 to 50,000 150 to 200 Business accounting (one-off)100,000 to 150,000400 to 500 Company accounting (one-off)200,000 +600 + barrel Returns (one-off)0 to 100,000100 barrel Returns (one-off)100,000 to 200,000150 to 200 VAT Returns (one-off)200,000 to 400,000200 + Payroll Service (ongoing)10 to 50 employees100 to 200 per month Payroll Service (continuous)100 + employees500 + each month For a company turning over between 20,000 to 50,000, a one-off company accounting cost would be in between 150 to 200, while for business turning over between 100,000 to 150,000, the cost will rise to 400 to 500.

Looking next at VAT returns, a one-off for a business taking between 0 to 100,000 each year will cost 100, while for values between 100,000 to 200,000, it will cost between 150 to 200. For the same VAT service, however for a company taking in between 200,000 to 400,000, the cost can be over 200.